Insuring a listed building is just like insuring any other property. The same questions are asked, the same underwriting applies, the only issue is the majority of underwriters are not keen on taking on this type of risk.

When a property dates back hundreds of years there could be plenty of minefields with the building. The foundations, the brick work the ground it was built upon the materials used etc. This is where specialist insurers come in to cover the eventuality of a claim. The insurers we use for listed building insurance know what they are taking on. If you have this type of building there might be a specific stone or a specific tile that needs to be replaced and these insurers know all the specialists to put your property back to all its original state.

BELOW is some information from English Heritage which gives you great insight into listing properties:

Listed buildings mark a building’s architectural and historic interest, it also brings it under the consideration of the planning system so that some thought will be taken about its future.

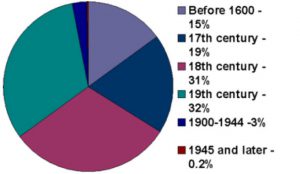

The older a building is, the more likely it is to be listed.

All buildings built before 1700 which survive in anything like their original condition are listed, as are most of those built between 1700 and 1840. Careful selection is required for buildings from the period after 1945. A building normally needs to be over 30 years old to be eligible for listing.

Categories of Listed Buildings

- Grade I buildings are of exceptional interest, sometimes considered to be internationally important; only 2.5% of listed buildings are Grade I

- Grade II* buildings are particularly important buildings of more than special interest; 5.5% of listed buildings are Grade II*

- Grade II buildings are nationally important and of special interest; 92% of all listed buildings are in this class and it is the most likely grade of listing for a home owner.

England has over 370,000 listed properties plus we have:

- 19,000, scheduled ancient monuments

- 1,600 registered historic parks and gardens

- 9,080 conservation areas

- 43 registered historic battlefields

- 46 designated wrecks

- 17 World Heritage sites

How will this affect me?

Listing is not a preservation order, preventing change. Listing is an identification stage where buildings are marked and celebrated as having exceptional architectural or historic special interest, before any planning stage which may decide a building’s future.

Listing does not freeze a building in time, it simply means that listed building consent must be applied for in order to make any changes to that building which might affect its special interest.

Listed buildings can be altered, extended and sometimes even demolished within government planning guidance. The local authority uses listed building consent to make decisions that balance the site’s historic significance against other issues such as its function, condition or viability.

So building insurance for a grade two listed building or building insurance for a grade 1 listed building shouldn’t be that difficult whether it be insurance for a listed commercial premises or insurance for a listed house.